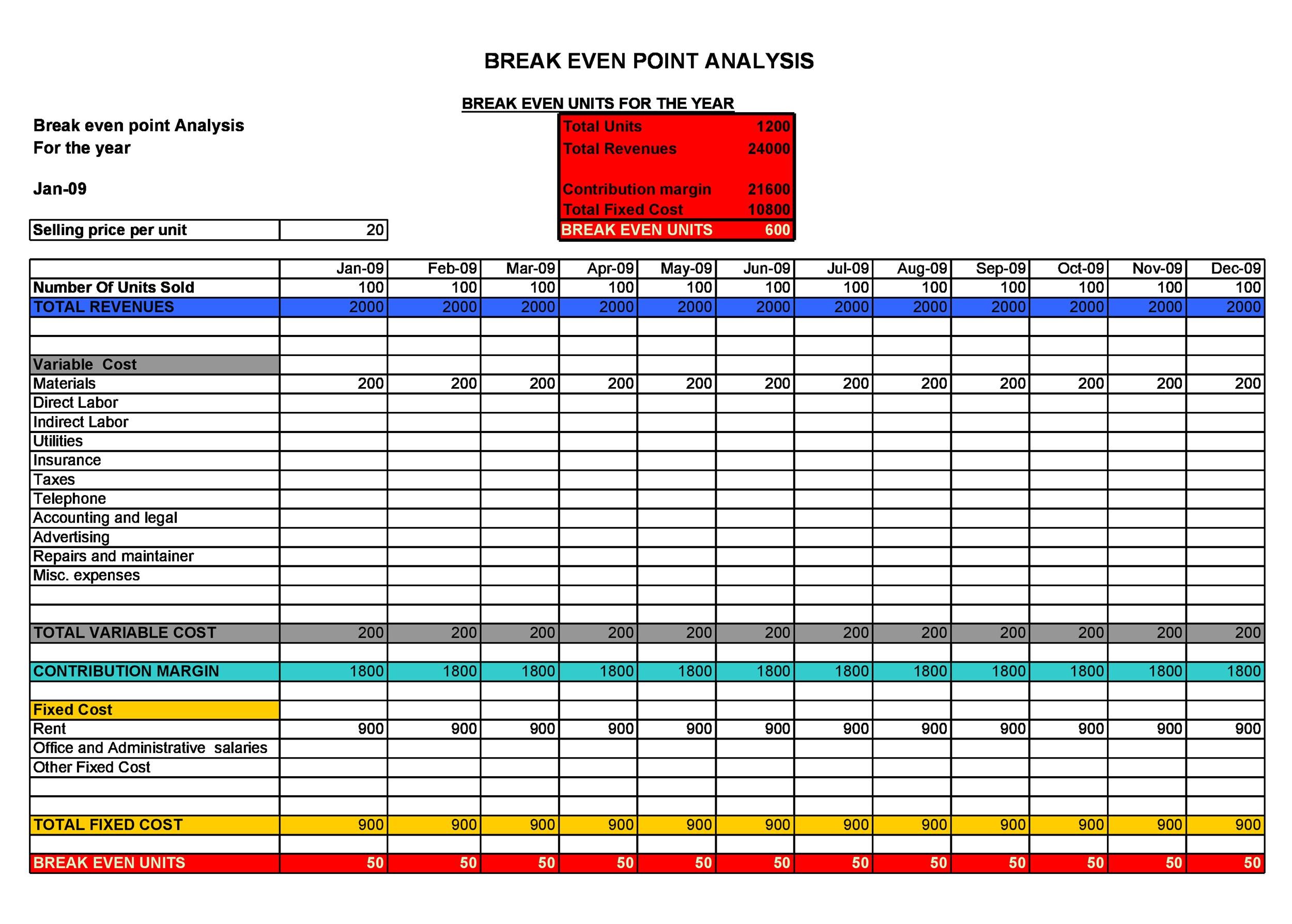

In this breakeven point example, the company must generate $2.7 million in revenue to cover its fixed and variable costs. The Break Even Point is determined by the moment when the fixed costs have been earned back. That only happens because of the so-called contribution margin; the selling price minus the variable costs.

Understanding Breakeven Points

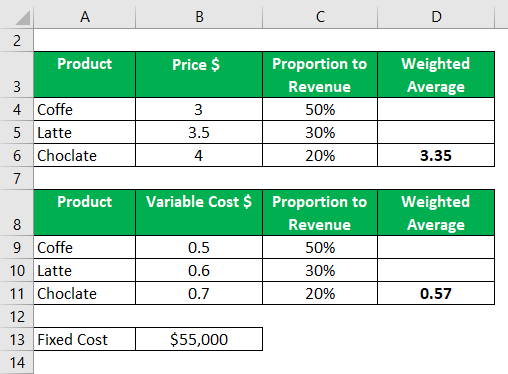

Understanding these components and their relationships is vital to the effective use of break-even analysis in business planning and decision-making. Once you’re above the break-even point, every additional unit you sell increases profit by the amount of the unit contribution margin. This is the amount each unit contributes to paying off fixed costs and increasing profits, and it’s the denominator of the break-even analysis formula. To find it, subtract variable costs per unit from sales price per unit. It is also helpful to note that the sales price per unit minus variable cost per unit is the contribution margin per unit.

Benefits of a Breakeven Analysis

While it isn’t sufficient on its own for assessing overall financial health, it does provide a clear benchmark for profitability. Break-even analysis demonstrates how many units you must sell or the total sales you should make to reach a break-even point. The break-even formula in sales dollars is calculated by multiplying the price of each unit by the answer from our first equation.

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

What is the formula for break-even analysis?

- The breakeven point can also be used in other ways across finance such as in trading.

- To help you find the answers, here are some useful definitions and some strategies.

- It’s the amount of sales the company can afford to lose but still cover its expenditures.

- Break-even analysis, also known as break-even point analysis, involves calculating the point at which a business breaks even and what steps it might take to become profitable.

- Now, it’s easy to lower fixed costs, especially when you’re starting a new business.

A business might be able to break even at a particular sales volume but may not generate sufficient cash flows or profits to sustain operations in the long term. Break-even analysis is a versatile tool that can be applied in numerous areas of business management and decision-making. Its most important applications are in business planning, financial modeling, and pricing strategy. Because your break-even point concerns the price relationship to your expenses, you can calculate different break-even points based on sold units or different pricing schemes. For example, you may find that your product is unprofitable at a certain price point except at extremely large scales.

Break-Even Analysis: Formula and Calculation

The key components of break-even analysis are fixed costs, variable costs, unit contribution margin, and break-even point, which represents the sales volume needed to cover all costs. Break-even analysis assumes that variable costs will change proportionately with output and that fixed costs will remain constant, regardless of the level of production. In reality, costs can be semi-variable (part fixed, part variable) and can change at different rates. For instance, buying raw materials in bulk can reduce the variable cost per unit due to quantity discounts. Once you have the contribution margin, you then take the total fixed costs per unit and divide those costs by the contribution margin. This will give you the break-even number of units required to offset your costs.

The breakeven formula for a business provides a dollar figure that is needed to break even. This can be converted into units by calculating the contribution margin (unit sale price less variable costs). Dividing the fixed costs by the contribution margin will reveal how many units are needed to break even. Therefore, given the fixed costs, variable costs, and selling price of the water bottles, Company A would need to sell 10,000 units of water bottles to break even. When starting a new business, this analysis can help you find out if your business idea is financially viable before you invest too much time or money. For example, If your startup costs are $50,000 and your product sells for $50 with a $20 production cost, break-even analysis shows you’ll need to sell roughly 1,700 units to cover your expenses.

Now Barbara can go back to the board and say that the company must sell at least 2,500 units or the equivalent of $1,250,000 in sales before any profits are realized. Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). Alternatively, completed contract method meaning examples the break-even point can also be calculated by dividing the fixed costs by the contribution margin. The Break-Even Point (BEP) is the inflection point at which the revenue output of a company is equal to its total costs and starts to generate a profit.

If you won’t be able to reach the break-even point based on the current price, it may be an indicator that you need to increase it. This is beneficial for businesses that have been selling the same product at the same price point for years or businesses that are just beginning and are unsure of how to price their product. A break-even analysis would quickly show how larger numbers of products would have to be sold before costs could be covered. That’s why this is typically a short-term strategy to draw attention to a product and start earning revenue from it. • To calculate the break-even point, divide fixed costs by the contribution margin.

Conversely, businesses with lower break-even points might be more resilient to changes in the market, as they need fewer sales to cover their costs. Understanding the financial dynamics of a business is a critical task for managers, investors, and entrepreneurs. However, it’s important to remember that fixed costs, which are an important part of calculating your break-even point, may accumulate faster than you can sell your product. However, a break-even analysis demonstrates the production or sales volume required to generate profits. This way you can evaluate whether it’s feasible or not to launch the product.