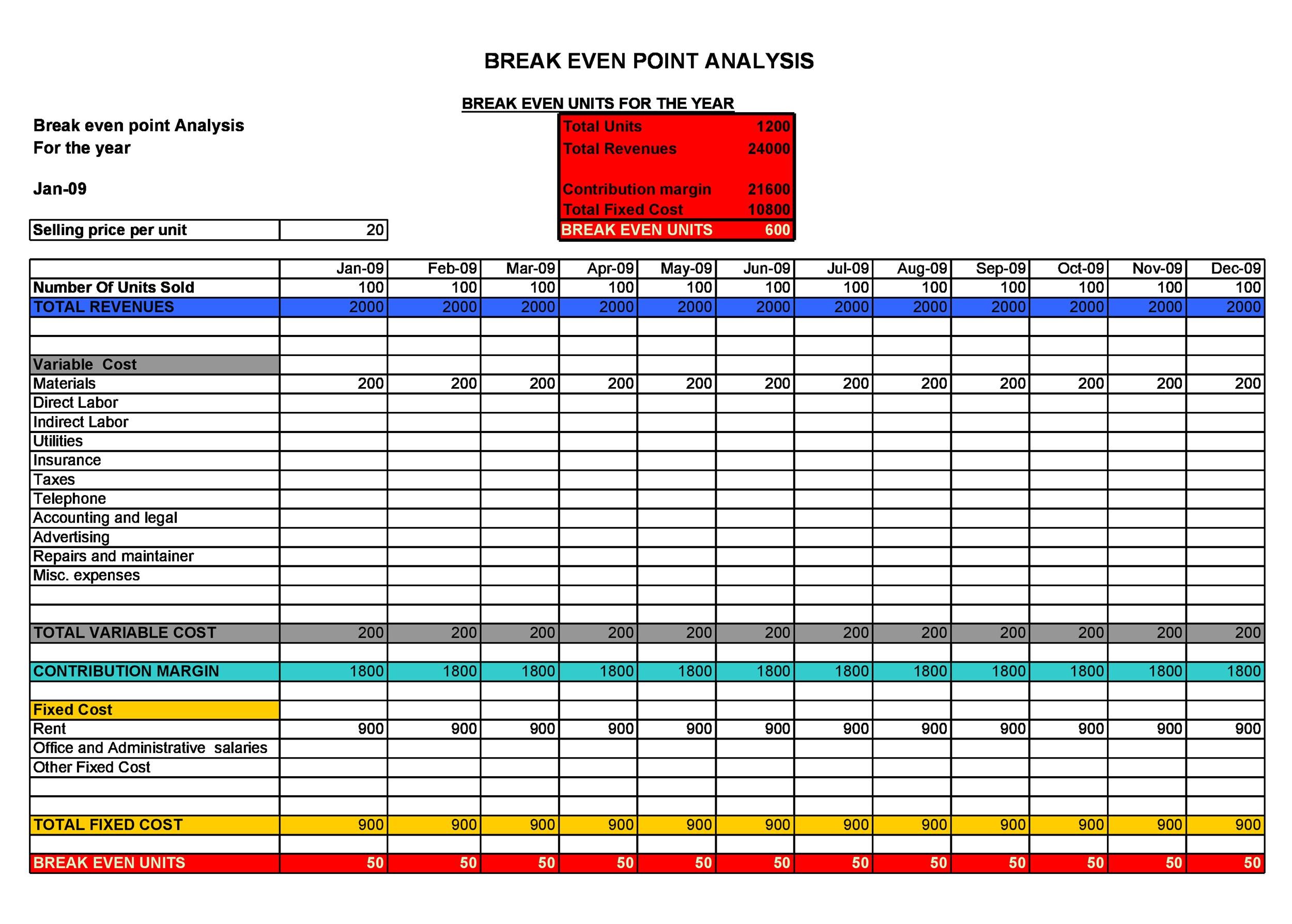

This is done by dividing the total fixed costs by the contribution margin ratio. You can figure out your contribution margin ratio by taking the contribution margin per unit and dividing it by the sales price. The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product.

Mitigate financial risks

Calculating breakeven points can be used when talking about a business or with traders in the market when they consider recouping losses or some initial outlay. Options traders also use the technique to figure out what price level the underlying price must be for a trade so that it expires in the free online bookkeeping course and training money. A breakeven point calculation is often done by also including the costs of any fees, commissions, taxes, and in some cases, the effects of inflation. The breakeven point is important because it identifies the minimum sales volume needed to cover all costs, ensuring no losses are incurred.

Determine the sales price per unit

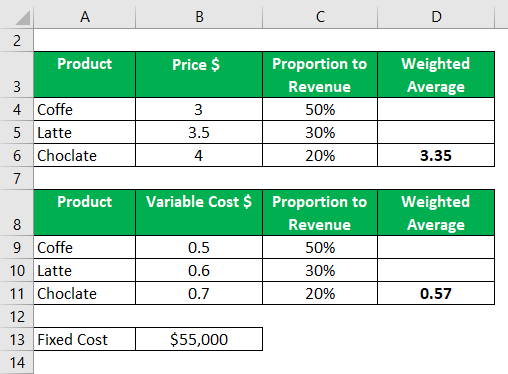

More sophisticated techniques, such as weighted average contribution margin, may need to be used in these cases. In the early stages of a business or when launching a new product, break-even analysis can help entrepreneurs set realistic sales targets. Break-even analysis involves the interplay of various components, primarily fixed costs, variable costs, and the contribution margin. Understanding these elements is essential to conducting a break-even analysis. Ideally, your pricing should cover fixed and variable costs per unit.

Determine profitability

Options can help investors who are holding a losing stock position using the option repair strategy. An efficient and effective approach will also help with the speed of production, allowing more closets to be produced in less time. That means that the carpentry business won’t break even until they sell 350 of these closets, and won’t make a profit until the 351th one. It’s a Bohemian model of rough, white-washed woos with two doors and a drawer at the bottom. The closet is almost two metres high, 1.50 metres wide and 0.5 metres deep. There are shelves in the closet and there is an area to hang up clothes, making it suitable as a wardrobe.

Why You Can Trust Finance Strategists

When it comes to securing investors, especially starting out, they want to see that you’ve done your homework and understand how your business will make money. It shows potential investors how much you need to sell to cover your costs and when they can expect to see returns on their investment. Break-even analysis can help determine those answers before you make any big decisions. For example, if the demand for your product is smaller than the number of units you’ll need to sell to breakeven, it may not be worth bringing the product to market at all. Finding your break-even point gives you a better idea of which risks are really worth taking. In certain industries, surge pricing (also known as dynamic pricing) could apply.

A break-even analysis can be used to continuously audit and fine-tune your pricing strategy. If you find sales are missing expectations, you can reference this calculation to easily understand what quantities must be sold if you decide to adjust the price. Conducting a break-even analysis is a crucial tool for small business owners. If you’re planning on launching a business, writing a business plan, or just exploring a new product, knowing your break-even point can tell you whether or not a product or service is a good idea. Break-even analysis might just be a small part of a larger financial planning approach. It, however, is an important metric to help you regulate the costs, strategize the pricing, and set realistic goals.

Thus, the following are some of the differences between the two concepts but both are widely used in the financial market. First, let us give you a brief idea of what these numbers from General Motors’s Annual Report (or 10K) signify. Thus, it tells us at what level the investment has to reach so that it can recover its initial outlay. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.

- Break-even analysis looks at internal costs and revenues, but doesn’t factor in external influences that can impact your business.

- In the first approach, we have to divide the fixed cost by contribution per unit i.e.

- Understanding these components and their relationships is vital to the effective use of break-even analysis in business planning and decision-making.

- This metric is important for new businesses to determine if their ideas are viable, as well as for seasoned businesses to identify operational weaknesses.

- Conversely, businesses with lower break-even points might be more resilient to changes in the market, as they need fewer sales to cover their costs.

Break-even analysis is often a component of sensitivity analysis and scenario analysis performed in financial modeling. Using Goal Seek in Excel, an analyst can backsolve how many units need to be sold, at what price, and at what cost to break even. For a carpentry business, mainly the costs for raw materials, auxiliary materials, semi-finished goods such as wood, nails and copper handles, are variable.

The relationship between contribution margin and breakeven point is that even a dollar of contribution margin chips away at a company’s fixed cost. A higher contribution reduces the number of units needed to break even because each unit contributes more towards covering fixed costs. Conversely, a lower contribution margin increases the breakeven point, requiring more units to be sold to cover fixed costs.

Break-even analysis looks at fixed costs relative to the profit earned by each additional unit produced and sold. In the second approach of break even analysis method, we have to divide the fixed cost by contribution to sales ratio or profit-volume ratio i.e. If you won’t be able to reach the break-even point based on your current price, you may want to increase it. Increasing the sales price of your items may seem like an impossible task.