This means that the only thing holding back your ability to break even is how fast you sell your units. Upmetrics business planning app helps you calculate and evaluate the break-even for your complex business processes with utmost ease. Its guided approach, AI-powered functionality, and automated detailed forecasts make it easier even for the new planners to calculate break-even.

What Is a Breakeven Point?

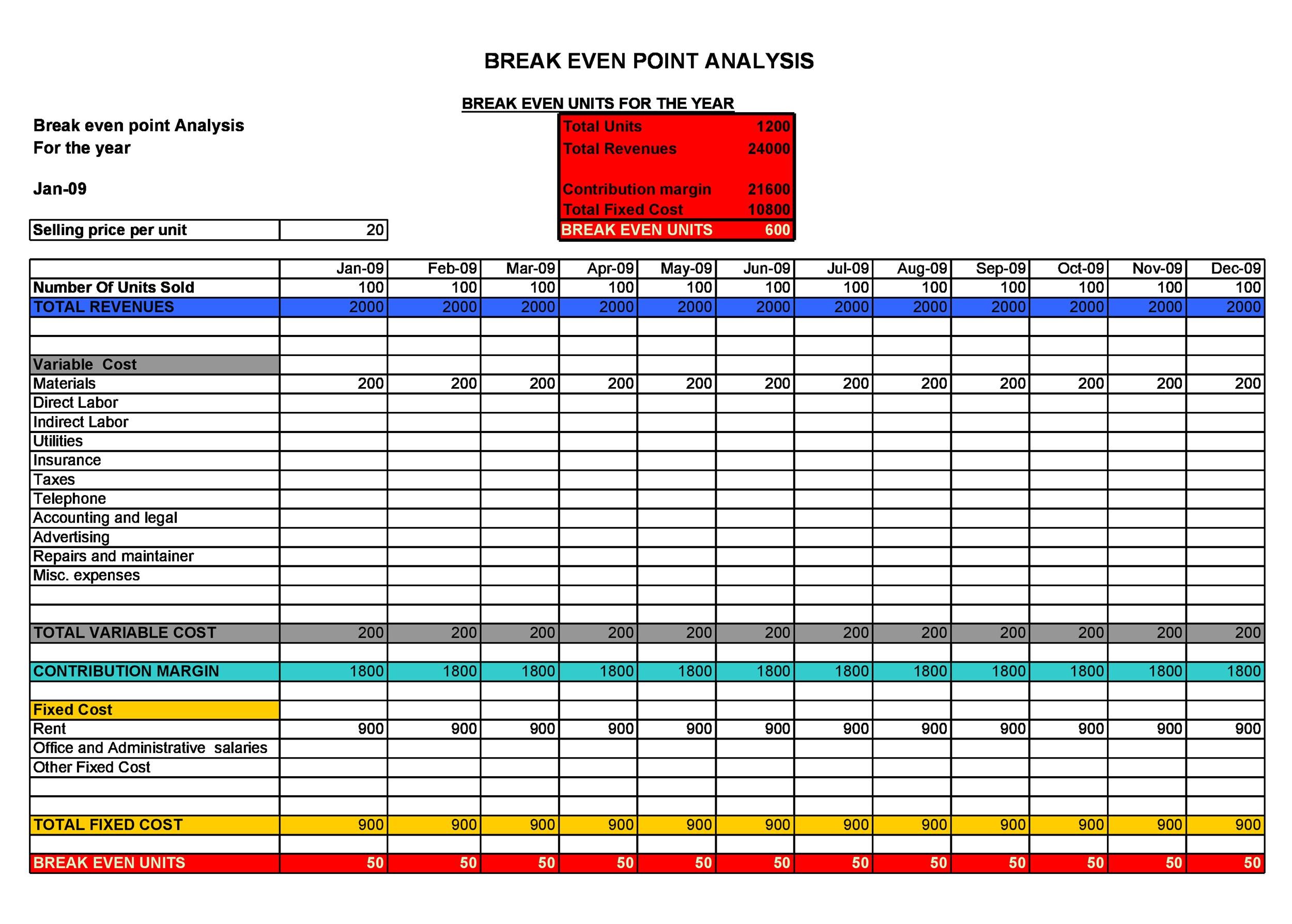

As you can see, the list is exhaustive and relevant to the food truck business. You may consider this as a checklist to ensure that you don’t leave behind any important expense stream. With this blog post, we will explain how to perform break-even analysis and how to reach your break-even faster with examples. Head over to our small business guide on setting up a new business if you want to know more. So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on. Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

- Let’s say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis.

- It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation.

- Even better, you can source from local providers to reduce transportation costs.

- Every business must develop a break-even point calculation for their company.

- One limitation of break-even analysis is that it assumes selling prices will stay the same over time.

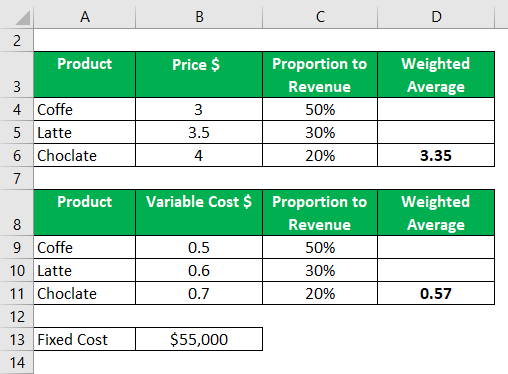

Calculate Break-Even Point by Sales Dollar – Contribution Margin Method

In order to help you advance your career, CFI has compiled many resources to assist you along the path. For instance, it’s the Marketing department’s task to offer the closets in an attractive way using various channels, including shops, online shops, is bookkeeping hard to learn all your questions answered design magazines and so on. It might be impossible for the Sales department to sell more than 350 of these closets. If your cost for office space can be lowered, check to see what impact this has on the break-even points of your product(s).

Calculating the break-even point in sales dollars

Yes, service-based businesses can apply the concept of break-even analysis. Here, instead of focusing on the number of units sold, break-even focuses on factors like client hours, project hours, or service contracts as their units for calculation. Another way to reach break-even faster is by raising the average selling price of your products. Similarly, let’s calculate break even at an average selling price of $11. This formula gives you the total number of units you should sell (sales volume) to reach a break-even point. This gives you the number of units you need to sell to cover your costs per month.

Additional Resources

Additionally, it focuses solely on profitability, overlooking cash flow and long-term financial health. The purpose of a break-even analysis is to determine the point at which a business’s revenue equals its total costs, meaning no profit or loss is made. It helps businesses understand the minimum sales needed to cover expenses. The break-even point is where an asset’s market price equals its original cost.

Great, we have special savings for organizing your business ideas.

This lets them know how much product they need to sell to cover the cost of doing business. As you can see, the Barbara’s factory will have to sell at least 2,500 units in order to cover it’s fixed and variable costs. Anything it sells after the 2,500 mark will go straight to the CM since the fixed costs are already covered.

For instance, if management decided to increase the sales price of the couches in our example by $50, it would have a drastic impact on the number of units required to sell before profitability. They can also change the variable costs for each unit by adding more automation to the production process. Lower variable costs equate to greater profits per unit and reduce the total number that must be produced. The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs. The break-even point is the point at which there is no profit or loss. Assume a company has $1 million in fixed costs and a gross margin of 37%.

It clarifies the relationship between sales, costs, and profits enabling the businesses to set realistic targets. Break-even analysis helps strategize your pricing, allowing reasonable room for margin. It enables you to evaluate pricing and sales under different situations, helping you set a reasonable pricing strategy for your products/services. It’s also important to keep in mind that all of these models reflect non-cash expense like depreciation.

They might also reveal that you could benefit from taking out a small business loan or otherwise accessing more funding. Now, it’s easy to lower fixed costs, especially when you’re starting a new business. To clarify, fixed costs are the ones that remain consistent regardless of the sales volume. Break-even analysis offers a quick snapshot of the business’s financial health.

The hard part of running a business is when customer sales or product demand remains the same while the price of variable costs increases, such as the price of raw materials. When that happens, the break-even point also goes up because of the additional expense. Aside from production costs, other costs that may increase include rent for a warehouse, increases in salaries for employees, or higher utility rates. When you outsource fixed costs, these costs are turned into variable costs. Variable costs are incurred only when a sale is made, meaning you only pay for what you need.